Master Financial Analysis Through Real Market Experience

Genuine fundamental analysis isn't just theory from textbooks. It's about understanding what makes companies actually valuable and why markets move the way they do.

Discover Our ApproachFinancial Education Excellence

Genuine fundamental analysis isn't just theory from textbooks. It's about understanding what makes companies actually valuable and why markets move the way they do.

Discover Our Approach

Reading financial statements isn't about memorizing ratios. We focus on spotting the stories behind numbers and understanding what management is really telling you between the lines.

Every company exists within an industry ecosystem. Understanding competitive dynamics, regulatory changes, and cyclical patterns helps you see the bigger picture that individual metrics can't show.

Economic cycles, interest rate environments, and market sentiment all influence valuations. Learning to read these broader signals helps you time your analysis and expectations appropriately.

Most people think fundamental analysis is just about calculating price-to-earnings ratios or book values. That's only the starting point. Real analysis means understanding business models, competitive advantages, and management quality.

Here's what I've noticed after years of watching people try to learn fundamental analysis: they get caught up in formulas and forget that they're analyzing real businesses run by real people in constantly changing markets.

The companies that look cheapest on paper often have hidden problems. The ones that seem expensive might be bargains if you understand their competitive position. Numbers tell part of the story, but context tells you whether that story makes sense.

"Understanding the 'why' behind financial results matters more than memorizing the 'what' of financial ratios."

Our programs start in September 2025, giving you time to build the foundation knowledge that makes advanced analysis actually meaningful.

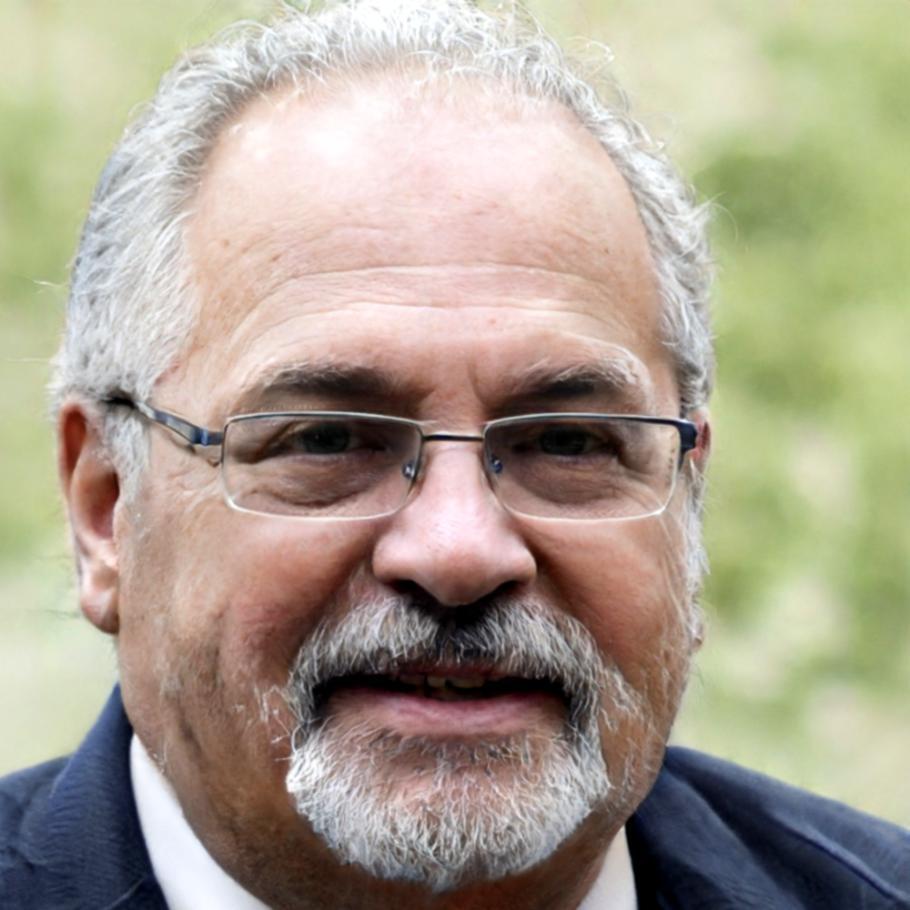

Senior Market Analyst

Two decades analyzing Australian markets taught me that the best insights come from combining rigorous research with real-world market experience. That's exactly what we bring to our educational programs.